We are committed to providing the information and resources you need to navigate the challenges of this unprecedented time.

Updated: 4/5/20

As small businesses in our community face uncertainty about the future, we want to share information about federal programs offering financial relief.

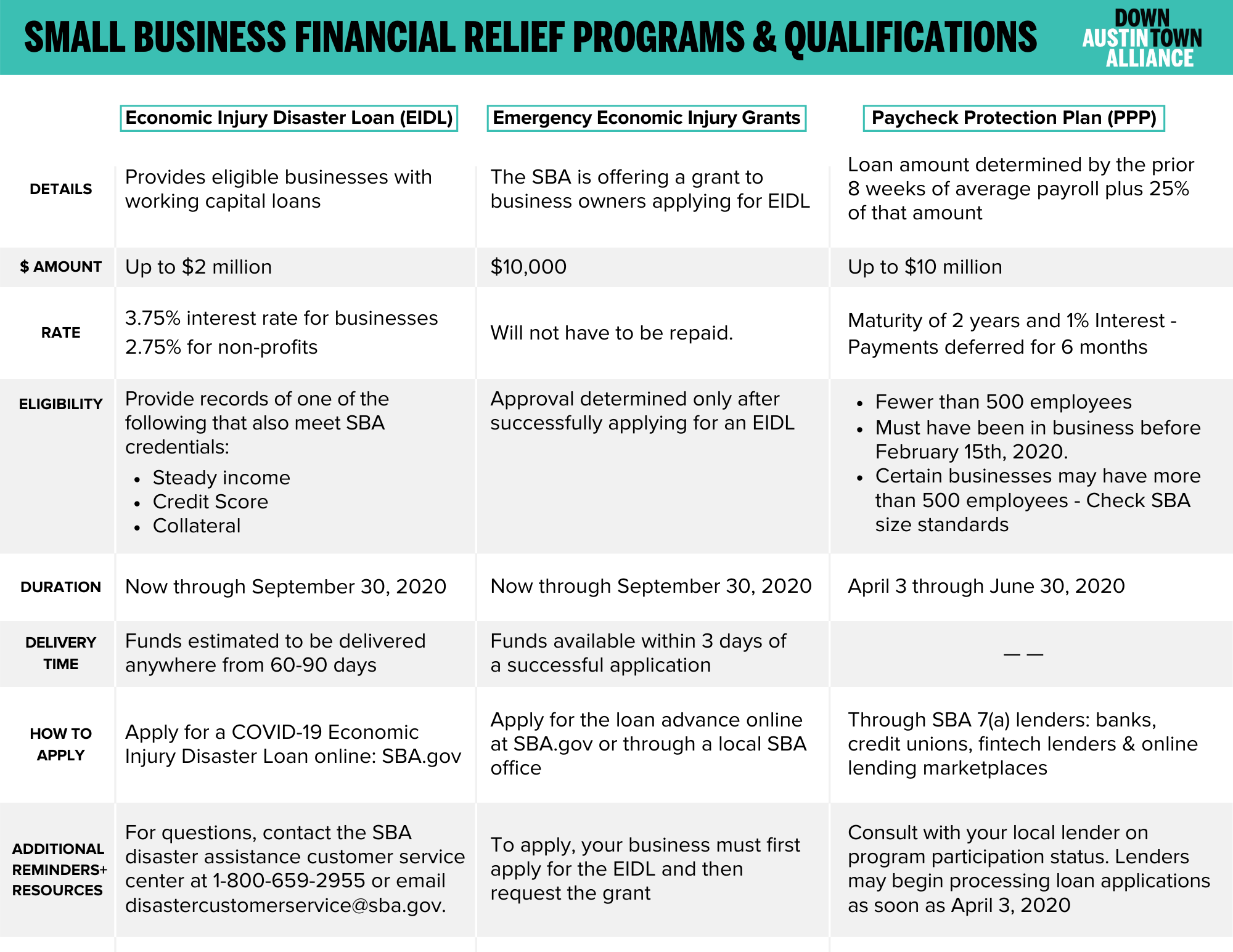

The recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act includes financial support for small businesses and nonprofits. There are three programs available through the U.S. Small Business Administration, including the Paycheck Protection Program (PPP), which resumed on April 27. These programs are designed to provide economic relief through low-interest loans to businesses experiencing a loss of revenue caused by the COVID-19 pandemic.

Learn more about the Main Street Lending Program

Here are the basics about each program to help you apply for your small business or nonprofit organization.

Click here to review the small business owner’s guide to the CARES Act.

Paycheck Protection Program

The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll.

Watch this short video with Molly Alexander, executive director of the Downtown Austin Alliance Foundation, who is also a small business owner, about how to navigate the application process for the Paycheck Protection Program.

QUALIFICATIONS

-

Businesses with fewer than 500 employees

-

Must have been in business before February 15th, 2020

-

Small businesses in the hospitality and food industry with more than one location could also be eligible at the store and location level if the store employs less than 500 workers. This means each store location could be eligible.

-

Businesses in certain industries may have more than 500 employees if they meet the SBA’s size standards for those industries

LOAN AMOUNTS & DELIVERY OF FUNDS

Businesses can qualify for loans up to $10 million – loan amount is determined by 8 weeks of prior average payroll (including independent contractors) plus an additional 25% of that amount.

RATES & PAYMENTS

PPP loans have a maturity of 2 years and an interest rate of 1%. Payments will be deferred for 6 months, plus, SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.

APPLICATION TIMELINE

Available starting April 3, 2020, through June 30, 2020.

HOW TO APPLY

-

Through any existing SBA 7(a) lender, including any federally insured depository institution, through a federally insured credit union, or Farm Credit System institution that is participating.

-

Includes Fintech lenders, as well as online lending marketplaces

Other regulated lenders will be available once they are approved and enrolled in the program. Consult with your local lender as to whether it is participating in the program. Lenders will begin processing loan applications as soon as April 3, 2020.

Click here to view/download the application form.

—

Economic Injury Disaster Loans

EIDL offers eligible small businesses with working capital loans to provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing due to COVID-19.

QUALIFICATIONS

Approval depending applicant’s ability to provide records of (one) of the following that also meets SBA criteria:

Steady Income, Credit Score, or Collateral

LOAN AMOUNTS & DELIVERY OF FUNDS

EIDL provides eligible small businesses with working capital loans of up to $2 million in assistance.

Funds estimated to be delivered to recipients anywhere from 60 to 90 days.

RATES

-

3.75% (for-profit) for up to 30 years on a case-by-case basis

-

2.75% (non-profit) for up to 30 years on a case-by-case basis.

APPLICATION TIME WINDOW

Accepting applicants now through September 30, 2020

HOW TO APPLY

Apply online for a COVID-19 Economic Injury Disaster Loan.

TIP: For questions about the application, you can contact the SBA disaster assistance customer service center at 1-800-659-2955 or email disastercustomerservice@sba.gov.

—

Emergency Economic Injury Grants

The SBA is offering a quick Emergency Economic Injury Grant to any business owner that applies for the EIDL.

QUALIFICATIONS

Any business owner that applies for the EIDL can request the Emergency Grant. Business owners must first successfully complete the EIDL application and then request the grant after applying.

LOAN AMOUNTS & DELIVERY OF FUNDS

Emergency Grant amount of $10,000 will be made available within 3 days of a successful application.

RATES & PAYMENTS

This loan advance will not have to be repaid.

APPLICATION TIME WINDOW

Accepting applicants now through September 30, 2020

HOW TO APPLY

Apply for the Loan Advance here. or through a local SBA office.

TIP: If you’re applying for an EIDL, it’s recommended that you complete the grant request and take advantage of what could be a $10,000 lifeline for your business.